COVID-19 Investment Management Related Updates

Below is our compilation of communications that are relevant to investment managers. Please let us know if you are looking for additional information and we will strive to update this as time goes on. Stay safe and sane – CFM 4/14/20

****

The Coronavirus Aid, Relief, and Economic Security Act (CARES Act). On March 27, Congress passed the $2 Trillion CARES Act, the largest financial relief bill in history, aimed at providing financial assistance to businesses and individuals to alleviate the economic fallout caused by the COVID-19 public health crisis. A core focus of the CARES Act is $350 billion in financial aid for small businesses through federal loans under a new Small Business Administration (“SBA”) loan program called the Paycheck Protection Program (the “PPP”). Here is our post on highlights of the program in regards to financial relief for small businesses.

SEC Regulatory Relief for Funds and Investment Advisers Affected by COVID-19. The SEC announced it will provide conditional relief to investment advisers and investment funds affected by COVID-19. In particular, the SEC order grants relief for investment advisers from certain Form ADV and Form PF filing obligations. Disruptions caused by COVID-19 to transportation, access to facilities, support staff and the ability for gatherings, among other things, may prevent or delay investment advisers and investment funds from meeting regulatory obligations. As a result, registered investment advisers (“RIAs”) and exempt reporting advisers (“ERAs”) affected by COVID-19 can expect conditional relief regarding the filing of amendments to Form ADV and reports on Form ADV part 1A, respectively. Further, the order provides conditional relief for RIAs affected by COVID-19 in regards to delivery of amended brochures, brochure supplements or summaries of material changes to clients where the disclosures are not able to be timely delivered. Private fund advisers affected by COVID-19 can also expect relief from Form PF filing requirements. For an entity seeking reliance upon the conditional relief, the SEC order requires a statement of notification to Commission staff (promptly via email to the SEC at [email protected]) of the intention to rely upon the order and the disclosure of information in the form of a brief description by the adviser of the reasons why it could not file or deliver its Form ADV or Form PF on time. Clients and investors of the adviser must also be notified. Disclosure in regards to reliance upon the order for Form PF filings should be made promptly via email to the SEC at [email protected]. The order requires filing Form ADV and/or Form PF, as applicable, as soon as practicable, but not later than 45 days from the original deadline. The Commission and the staff are continuing to assess the impacts and will be considering further relief designed to help funds and advisers to continue operations and meet regulatory deadlines. For general questions or concerns related to impacts of coronavirus on the operations or compliance of funds and advisers, please contact us.

CFTC Extended Deadlines Due to COVID-19. The CFTC has extended deadlines for Commodity Pool Operators (“CPOs”) in light of recent world events, most notably the COVID-19 global pandemic. The extensions only apply to CPOs which have reporting obligations, generally this means fully registered CPOs and those subject to Rule 4.7 relief. Moreover, these extensions only apply to CPOs “where compliance is anticipated to be particularly challenging or impossible because of displacement of registrant personnel from their normal business sites…in response to the COVID-19 pandemic.” The extension applies to (i) Form CPO-PQR where small and mid-size filers must file their annual Form CPO-PQR by May 15, 2020 and large filers (who were already expected to deliver the annual Form CPO-PQR) may file their Q1 2020 Form CPO-PQR by July 15, 2020; (ii) Pool annual reports under CFTC Rule 4.7(b)(3) and 4.22(c), such annual reports were originally due on April 30, 2020 but the extension allows CPOs to deliver these annual reports to the NFA and pool participants no later than 45 days after the original due date of April 30, 2020 (note: CPOs may also seek up to an additional 180 days from the end of their fiscal year to file under the “hardship” provisions of CFTC Rule 4.22(f); and (iii) Periodic account statements under Commission Regulations 4.7(b)(2) or 4.22(b), these monthly or quarterly reports for periods ending on or before April 30, 2020 may be delivered to pool participants within 45 days after the end of the reporting period. Such relief by the CFTC is not without conditions – if CPOs do indeed rely on such extensions they must: (i) Establish and maintain a sufficient supervisory system reasonably designed to supervise the activities of personnel while working from alternative or remote locations during the COVID-19 pandemic; and (ii) return to ordinary compliance with all CFTC rules covered by the relief as the COVID-19 pandemic abates. Moreover, CPOs should thoroughly document the activation and application of any relevant business continuity policy in response to COVID-19 as the matter could easily become an item of interest on future NFA exams.

Investment Management Firms May Be Considered Essential Financial Businesses Under Federal Guidance and State Orders. The Cybersecurity and Infrastructure Security Agency (CISA) lists asset management as a vital component of our nation’s critical infrastructure. As the federal risk advisor, CISA created guidance to help state and local governments ensure that employees essential to operations are able to continue working. In consideration of CISA’s guidance, whether or not investment management firms would be considered essential financial businesses may depend upon each State’s directives. Generally, the best practice for firms moving forward is to require workers to telework or work-from-home if possible, but allow supporting personnel to continue selective operations in the office in order to ensure the firm’s continued operation.Please see our post for a state-by-state analysis of the exceptions provided in each States’ executive orders regarding essential business activities in light of the COVID-19 public emergency response.

SEC Update to Form ADV and Custody Rule FAQs, Relating to “Work From Home”. Two circumstances are at the forefront of this update, where 1) advisers might otherwise be required to identify home offices as places of business on the Form ADV; and 2) advisers may inadvertently receive securities from clients at an office location at which the advisers’ personnel may not have access to mail or deliveries. In regards to the first circumstance, the SEC FAQ indicates it would not take action against advisers who do not update Item 1F of Part 1A or Section 1F of Schedule D of their Form ADVs to represent remote/home offices from which employees are working as additional offices, unless the remote office arrangement (other than one’s principal office and place of business) is unrelated to the firm’s business and continuity plan. In regards to the second circumstance, under the Custody Rule, an investment adviser that inadvertently receives client funds or securities are required to return such securities to the client within three to five business days; otherwise, such adviser may be deemed to have custody of such securities. The SEC has revised the Custody Rule such that client assets are not considered received until firm personnel are able to access the mail or deliveries. As with most conditional relief provided by the SEC in light of COVID-19, the adviser must be unable to access mail or deliveries as a result of the circumstances caused by COVID-19.

NFA Relief for Commodity Pool Operators, Relating to “Work from Home”. Commodity pool operators (“CPO”), commodity trading advisors (“CTA”), and other NFA members implementing contingencies pursuant to their business continuity plans that permit employees, including registered Associated Persons (“APs”), to work from home, will not be subject to disciplinary action relating to the requirements that firms list as a branch office on its Form 7-R any location other than the main business address and that each branch office must have a branch office manager in compliance with Rule 2-7 that requires successful completion of the Series 30, Branch Manager Examination. The relief requires that the CPO or CTA implement and clearly document alternative supervisory methods and activities, especially surrounding recordkeeping requirements.

FINRA Pandemic-Related BCP, Guidance and Regulatory Relief, Relating to Regulatory Filings, “Work from Home”, Cybersecurity, and Forms U4 and BR. Member firms experiencing complications resulting from COVID-19 should contact their Risk Monitoring Analysists or relevant FINRA department to seek extensions. FINRA may waive late fees and provide conditional relief based on the member firm’s circumstances. As discussed earlier, firms are reminded to review, revaluate, and update their BCPs in consideration of pandemic preparedness. FINRA member firms are encouraged to contact their assigned FINRA Risk Monitoring Analyst to discuss the implementation of their BCPs, as well as challenges in such implementation, including disruption of business operations. In regards to remote offices or telework arrangements, FINRA expects member firms to maintain a supervisory system that is designed to supervise the activities of each associated person working remotely. FINRA further recommends steps to reduce the risk of a cybersecurity breach, including: “(1) ensuring that virtual private networks (VPN) and other remote access systems are properly patched with available security updates; (2) checking that system entitlements are current; (3) employing the use of multi-factor authentication for associated persons who access systems remotely; and (4) reminding associated persons of cybersecurity risks through education and other exercises that promote heightened vigilance.” In regards to Form U4/Form BR, FINRA is temporarily suspending the requirements to update Form U4 information about office employment addresses for registered persons and Form BR information regarding branch office applications for any newly opened temporary office location or space-sharing arrangements. Additionally, if a member firm relocates personnel to a temporary location that is not currently registered as a branch office, the firm must provide written notification to its FINRA Risk Monitoring Analyst. The notification should indicate at minimum the office address, the names of the member firms involved, the names of registered personnel, a contact telephone number, and expected duration, if possible.

Employment Considerations for Investment Management Firms Addressing COVID-19. With the spread of COVID-19, many employers are concerned about the health and safety of their employees and evaluating the steps that should be taken in response. We recommend that managers establish policies and procedures regarding COVID-19 and to ensure that any policies and procedures are uniformly applied, to avoid the risk of employee discrimination. If any employees exhibit flu-like symptoms, employers may ask such employees if they would like to seek medical attention and may require symptomatic employees to go home without violating the American Disabilities Act. If an employee’s condition could pose a “direct threat”, i.e. a significant risk of substantial harm to the health and safety of the individual or others that cannot be eliminated or reduced by reasonable accommodation, employers may also request that an employee be tested for COVID-19. If an employee tests positive for the virus, all employees who were in close contact with such employee should be sent home for a 14-day self-monitoring period, and other employees in the same work location should be informed of their potential exposure. As a reminder, employers should always ensure the confidentiality of employee medical information. As many workplaces shift to remote working, employers should make certain that their policies address the provision and proper use of technologies necessary for remote work. Managers should be especially careful to ensure adequate controls and safeguards are in place to protect confidential or sensitive information, particularly client information. Managers with questions policies and practices to address COVID-19 should speak with their firm’s outside counsel.

California’s Attorney General Pressed to Postpone Enforcement of CCPA. On March 17, a group of over 30 trade associations and businesses sent a letter to California’s Attorney General pushing to postpone the enforcement of the California Consumer Privacy Act (“CCPA”). The CCPA, which took effect on January 1, is expected to be enforced by the Attorney General starting July 1. The group who sent the letter requested a January 1, 2021 enforcement date in order to give businesses more time to prepare for enforcement given that, given the current climate of COVID-19, many are unable to prepare for enforcement and most are in need of prioritizing other business concerns, like the well-being and health of their employees. The Attorney General’s office has not officially responded to the letter, and an advisor to the Attorney General suggested that enforcement will either continue as planned or be pushed until CCPA revisions can be finalized. The Attorney General recently released proposed revisions clarifying the service provider exemption. One such revision would allow service providers to use personal information internally to improve their services subject to certain limitations. Fund managers should prepare for enforcement of the CCPA as planned, while awaiting a formal response from the Attorney General.

SEC Temporary Final Rule 10(c) to Address Form ID Notarization Issues. In recognition of the issues caused by the COVID-19 public health crisis for entities and individuals who require access to file in EDGAR and the requisite notarization of the authorized signature on the Form ID application required by Rule 10(b) of Regulation S-T, the SEC announced a temporary rule to allow applicants for EDGAR access to upload a signed copy of the Form ID without notarization. The temporary rule requires that within 90 days of obtaining access to EDGAR, applicants must obtain notarization of the authorized signature on a copy of the completed Form ID and upload it as correspondence to their EDGAR account.

SEC’s Office of Compliance Inspections and Examinations (OCIE) Off-Site Exams via Correspondence for Information on Firms’ Business Continuity Plans (BCP). The SEC’s OCIE has begun off-site examinations through correspondence requests for responses and documents related to firms’ written Business Continuity Plans, Pandemic Continuity of Operations Plans, and/or equivalent informal plans or guidance (collectively, “BCP”). Firms are expected to provide copies or locations of their BCPs and any firm-issued policies, procedures, guidance and other information tailored to address continuity of business operations relating to pandemics and specifically COVID-19. Additionally, the OCIE asks for written responses to questions regarding what aspects of plans have been implemented, what limitations firms have faced in their abilities to operate critical systems, whether working remotely has affected oversight of third-party vendors, whether the firms are prepared to operate remotely for several weeks (e.g. 3+) or months, if required, etc. As the economic and operational pressures resulting from COVID-19 are affecting businesses and the industry at large, firms are strongly encouraged to revisit and enhance their BCPs in light of the threats posed by significant business disruptions.

SEC Guidance Relating to Federal Proxy Rules for Annual Meetings, “Virtual” Meetings, and Presentations of Shareholder Proposals. Under state law, issuers are generally required to hold annual meetings with security holders. Issuers with securities registered under Exchange Act Section 12 are required to comply with federal proxy rules when soliciting proxy authority from their shareholders in connection with the annual meeting. These federal proxy rules include the delivery of proxy material such as definitive proxy statements and proxy cards. Under the relief, the SEC takes the position that an issuer that has mailed and filed its definitive proxy materials can notify shareholders of a change in the date, time, or location of its annual meeting without mailing additional soliciting materials or amending its proxy materials if the issuer: 1) releases a press announcement of the change; 2) files the announcements as definitive additional soliciting material on EDGAR; and 3) takes all reasonable steps necessary to inform other intermediaries in the proxy process and other relevant market participants. In regards to issuers contemplating “virtual” shareholder meetings, issuers are reminded that the ability to conduct “virtual” meetings is governed by state law and the issuer’s governing documents. Issuers intending on conducting such “virtual” meetings are expected to notify its shareholders, intermediaries in the proxy process, and other market participants with clear logistical details of how shareholders can access, participate, and vote in such meetings. Lastly, the guidance encourages issuers to provide shareholder proponents or representatives with alternative means of presenting their proposals during the 2020 proxy season. To the extent such a shareholder proponent or representative cannot present a proposal due to COVID-19, the SEC would consider this to be “good cause” under Rule 14a-8(h) to exclude the proposal for any meetings held in the following two calendar years.

SEC No-Action Relief for Consolidated Audit Trail (“CAT”) Obligations. The SEC Division of Trading and Markets is providing no-action relief for small and large broker-dealers that are required to report trade and order data for all National Market System (“NMS”) securities and over-the-counter (“OTC”) equity securities. Under Section 19(b)(1) of the Securities Exchange Act of 1934, industry members of a national securities exchange or members of a national securities association (“Members”) are required to report to the CAT, a central depository that receives data on NMS securities and OTC equity securities, among other things. Prior to this relief, broker-dealers would have been required to submit member data to the CAT by April 20, 2020. This deadline has been extended to May 20, 2020. Self-regulatory organizations (“SROs”) responsible for ensuring compliance with the CAT NMS Plan will also not take disciplinary action against their members consistent with this relief. Notwithstanding the above, broker-dealers are reminded to conduct production readiness testing and certification processes 14 days prior to reporting.

Short-Selling Bans in Austria, Belgium, France, Italy, and Spain. Under EU Short Selling Regulation, the EU member states of Austria, Belgium, France, Italy, and Spain have enacted temporary short-selling bans to prevent destabilizing trading following market decline resulting from COVID-19. Each European countries’ temporary bans vary in scope, and in particular, which stocks are regulated by each ban. Generally, the scope of the bans include prohibitions on creating or increasing net short positions and involve shares, including cash and derivative short positions. Most bans do not apply to indexed financial instruments when the shares subject to the ban represent less than 20% to 50% of the composition of the index, depending on the EU member state ban. For more information in relation to each respective ban, please see the full order of the decisions for each of the following countries: Austria, Belgium, France, Italy, and Spain.

Tax Matters. In consideration of the impacts of COVID-19, many states are passing budgets, emergency COIVD-19 supplemental appropriation and extension of certain deadlines. Please see our post for an outline of certain tax deadlines in salient jurisdictions.

Amidst Extreme Volatility Managers Must Assess Material Terms in Live Trading Agreements. Given extreme market volatility, managers must assess the deal terms governing trading agreements such as ISDA master agreements, prime brokerage agreements, and others as certain provisions and triggering events may detrimentally affect hedge funds in the midst of current market conditions. Such negotiated provisions regarding force majeure, material adverse change/effect, counterparty powers, business day determinations, business disruptions, etc. and should be reviewed in light of current market conditions. In particular, for fund managers with ISDAs in place, please read this article by Dave Rothschild, a partner of CFM.

For general questions or concerns related to impacts of coronavirus on the operations or compliance of funds and advisers, please contact us.

****

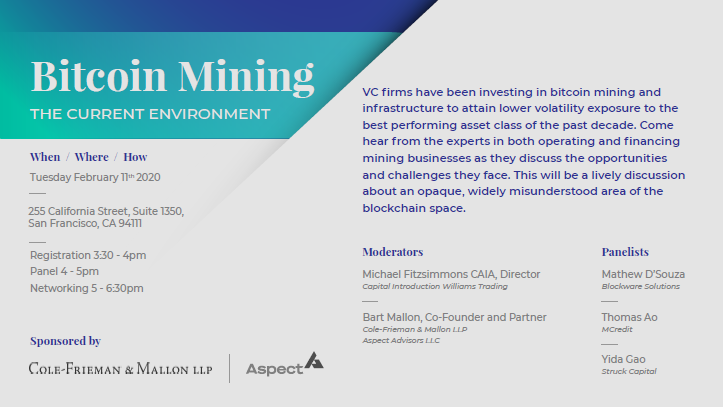

Bart Mallon is a founding partner of Cole-Frieman & Mallon LLP. Cole-Frieman & Mallon is a boutique law firm focused on providing institutional quality legal services to the investment management industry. For more information on this topic, please contact Mr. Mallon directly at 415-868-5345.